Our Purpose

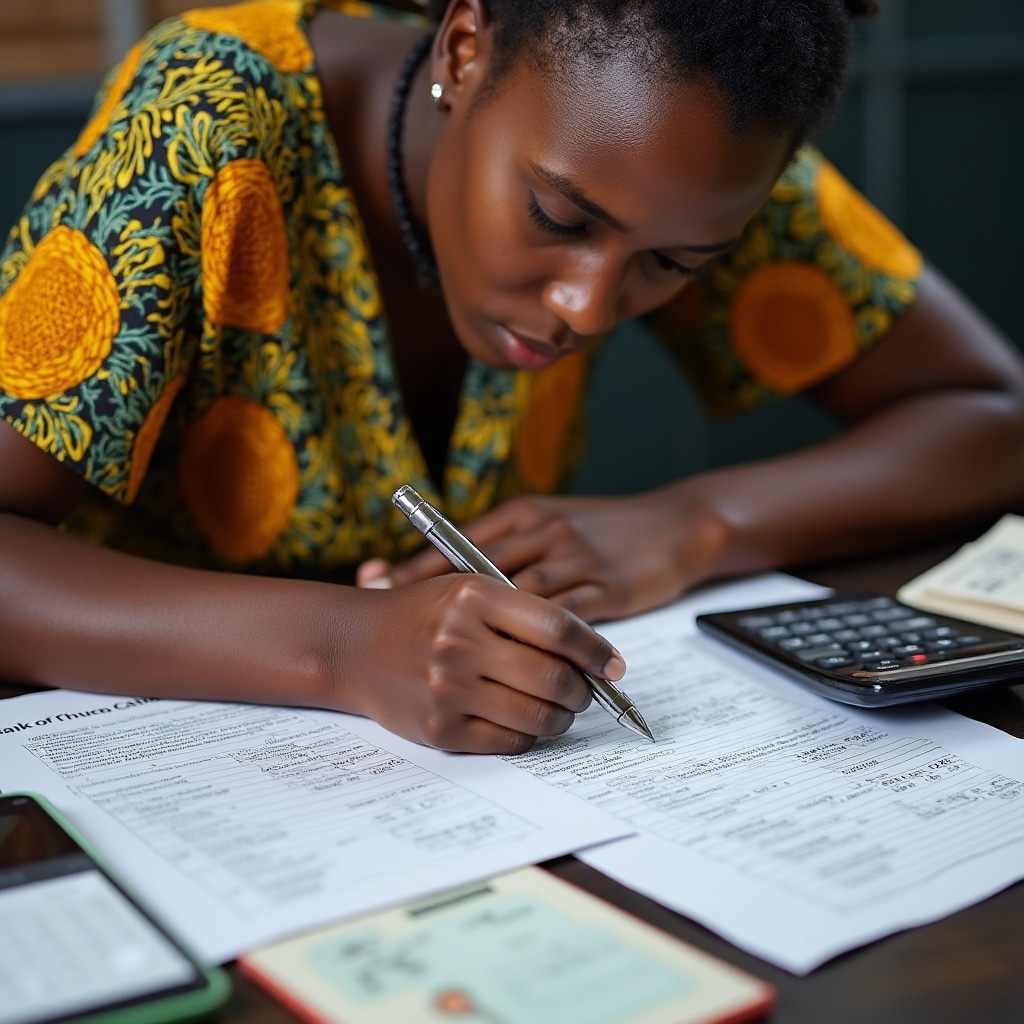

Credal Vento exists to provide professional training for mobile money agents across Ghana. We focus exclusively on education, helping aspiring and existing agents develop the knowledge they need to operate effectively, comply with regulations, and grow sustainable businesses.

We are not a mobile money operator, we do not recruit agents for any network, and we do not provide financial products or loans. Our sole mission is to deliver training that builds competence and professionalism in the mobile money agency sector.

The mobile money ecosystem in Ghana has transformed financial access for millions. Agents serve as the critical frontline, connecting people in rural communities with digital financial services. Quality training ensures these agents can serve their communities effectively while building profitable businesses.